INVESTMENT MANAGEMENTDave Paterson, CFA

Empire Life Investment Team |

WHY INVEST IN THIS FUNDThis fund may be right for a person seeking long-term capital growth and income through a globally diversified portfolio of equity and fixed income securities and is willing to accept a low to moderate level of risk. |

FUND FACTS| Asset Class | Portfolio Funds |

|---|

| Size (Mill) | $9.13 |

|---|

| Estimated MER (%)* | 2.98 % |

|---|

| Inception | January 18, 2021 |

|---|

| Total Holdings | 867 |

|---|

|

RISK TOLERANCE | | | | | | | | | |

|---|

| low | low to medium | medium | medium to high | high |

|

ASSET MIX| U.S. Equities | 35.2 % |

|---|

| Canadian Bonds | 29.8 % |

|---|

| U.S. Bonds | 12.9 % |

|---|

| International Equities | 11.0 % |

|---|

| Cash and Cash Equivalents | 6.6 % |

|---|

| International Bonds | 4.4 % |

|---|

| Canadian Equities | 0.2 % |

|---|

SECTOR MIX| Information technology | 34.8 % |

|---|

| Consumer discretionary | 14.5 % |

|---|

| Industrials | 12.3 % |

|---|

| Health care | 10.7 % |

|---|

| Communication services | 10.2 % |

|---|

| Financials | 7.3 % |

|---|

| Consumer staples | 6.6 % |

|---|

| Materials | 2.4 % |

|---|

| Utilities | 0.7 % |

|---|

| Real Estate | 0.3 % |

|---|

| Energy | 0.2 % |

|---|

|

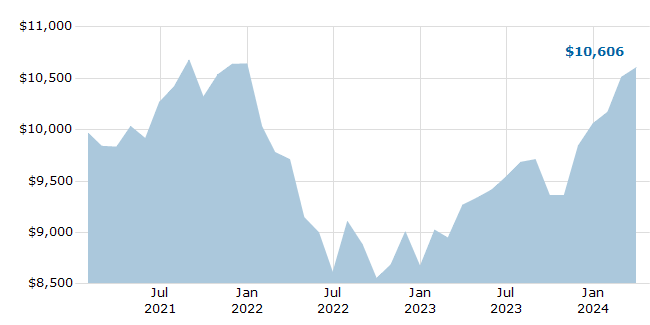

GROWTH OF $10,000

For Illustration Purposes Only

|

|

COMPOUND ANNUAL RETURNS| 1 mo | 3 mo | YTD | 1 yr | 3 yr | 5 yr | 10 yr | Inception |

|---|

| -1.05 | -5.90 | -4.03 | 7.41 | 6.74 | | | 2.53 |

CALENDAR YEAR RETURNS| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|

| | | | | | -18.53 | 16.07 | 15.25 |

|

EMPIRE LIFE MULTI-STRATEGY GLOBAL GROWTH BALANCED PORTFOLIO GIF

EMPIRE LIFE MULTI-STRATEGY GLOBAL GROWTH BALANCED PORTFOLIO GIF

EMPIRE LIFE MULTI-STRATEGY GLOBAL GROWTH BALANCED PORTFOLIO GIF

EMPIRE LIFE MULTI-STRATEGY GLOBAL GROWTH BALANCED PORTFOLIO GIF