INVESTMENT MANAGEMENTDave Paterson, CFA

Empire Life Investment Team |

WHY INVEST IN THIS FUNDYou are seeking long-term growth through capital appreciation by investing mainly in equity securities of Canadian corporations. |

FUND FACTS| Asset Class | Canadian Equity |

|---|

| Size (Mill) | $12.88 |

|---|

| MER | 3.29 % |

|---|

| Inception | October 23, 2019 |

|---|

| Total Holdings | 250 |

|---|

|

RISK TOLERANCE | | | | | | | | | |

|---|

| low | low to medium | medium | medium to high | high |

|

ASSET MIX (as at March 31, 2025)| Canadian Equities | 90.1 % |

|---|

| Cash and Cash Equivalents | 4.7 % |

|---|

| U.S. Equities | 3.7 % |

|---|

| International Equities | 1.4 % |

|---|

| Other Net Assets (Liabilities) | 0.1 % |

|---|

SECTOR MIX (as at March 31, 2025)| Financials | 28.5 % |

|---|

| Energy | 15.4 % |

|---|

| Industrials | 14.3 % |

|---|

| Materials | 12.0 % |

|---|

| Information technology | 7.7 % |

|---|

| Consumer staples | 6.9 % |

|---|

| Consumer discretionary | 5.7 % |

|---|

| Communication services | 3.2 % |

|---|

| Utilities | 3.2 % |

|---|

| Health care | 1.6 % |

|---|

| Real Estate | 1.3 % |

|---|

|

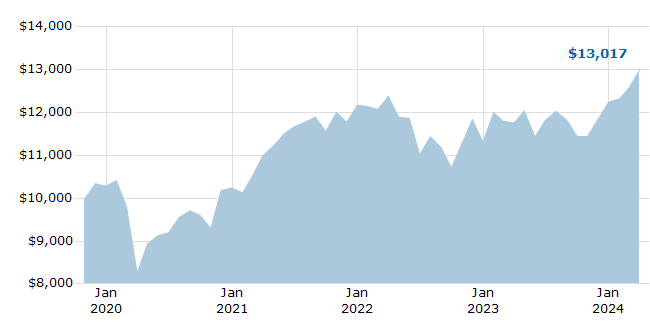

GROWTH OF $10,000

For Illustration Purposes Only

|

|

COMPOUND ANNUAL RETURNS| 1 mo | 3 mo | YTD | 1 yr | 3 yr | 5 yr | 10 yr | Inception |

|---|

| -0.52 | -1.94 | 0.30 | 12.44 | 6.44 | 9.92 | | 6.75 |

CALENDAR YEAR RETURNS| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|

| | | | -0.38 | 18.83 | -7.06 | 8.23 | 16.78 |

|

EMPIRE LIFE MULTI-STRATEGY CANADIAN EQUITY GIF

EMPIRE LIFE MULTI-STRATEGY CANADIAN EQUITY GIF

EMPIRE LIFE MULTI-STRATEGY CANADIAN EQUITY GIF

EMPIRE LIFE MULTI-STRATEGY CANADIAN EQUITY GIF