INVESTMENT MANAGEMENTEmpire Life Investment Team |

WHY INVEST IN THIS FUNDYou are seeking growth and income by investing primarily in equity and fixed income securities, with a target equity allocation of 35% |

FUND FACTS| Asset Class | Portfolio Funds |

|---|

| Size (Mill) | $144.10 |

|---|

| MER | 2.65 % |

|---|

| Inception | November 3, 2014 |

|---|

| Total Holdings | 345 |

|---|

|

RISK TOLERANCE | | | | | | | | | |

|---|

| low | low to medium | medium | medium to high | high |

|

ASSET MIX| Canadian Bonds | 61.1 % |

|---|

| Canadian Equities | 21.7 % |

|---|

| U.S. Equities | 8.1 % |

|---|

| International Equities | 5.5 % |

|---|

| Cash and Cash Equivalents | 2.8 % |

|---|

| U.S. Bonds | 0.7 % |

|---|

BOND TYPE| Investment Grade Corporate | 46.8 % |

|---|

| Provincial Government | 25.4 % |

|---|

| Federal Government | 24.3 % |

|---|

| Floating Rate | 2.7 % |

|---|

| Municipal Government | 0.8 % |

|---|

|

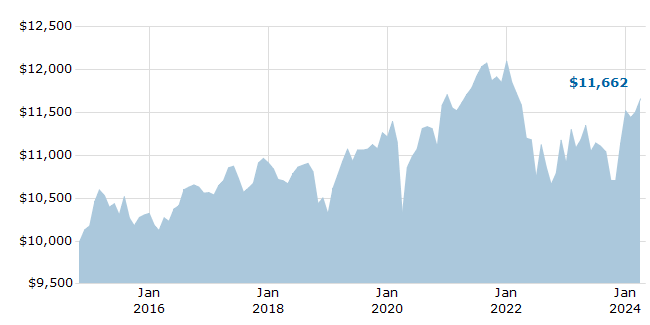

GROWTH OF $10,000

For Illustration Purposes Only

|

TOP 10 HOLDINGS| ROYAL BK OF CAD 4.95% 01APR24 TD | 2.3 % |

|---|

| Gov. of Canada, 2.5%, 12/1/2032 | 2.1 % |

|---|

| Government of Canada 2.000% December 1, 2051 | 1.8 % |

|---|

| Royal Bank of Canada | 1.6 % |

|---|

| Toronto-Dominion Bank | 1.2 % |

|---|

| Government of Canada 2.250% June 1, 2029 | 1.2 % |

|---|

| Province of Ontario, 3.65%, 6/2/2033 | 1.2 % |

|---|

| Inter Pipeline Ltd., 4.23%, 6/1/2027 | 1.1 % |

|---|

| Gov. of Canada, 2%, 6/1/2032 | 1.1 % |

|---|

| Canada Housing Trust No.1, 1.6%, 12/15/2031 | 1.0 % |

|---|

| Total of Top 10 | 14.6 % |

|---|

|

COMPOUND ANNUAL RETURNS| 1 mo | 3 mo | YTD | 1 yr | 3 yr | 5 yr | 10 yr | Inception |

|---|

| 1.32 | 1.22 | 1.22 | 4.27 | 0.13 | 1.30 | | 1.65 |

CALENDAR YEAR RETURNS| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|

| 2.35 | 3.30 | -5.48 | 8.73 | 4.40 | 3.33 | -9.88 | 5.66 |

|

EMPIRE LIFE EMBLEM CONSERVATIVE PORTFOLIO GIF

EMPIRE LIFE EMBLEM CONSERVATIVE PORTFOLIO GIF

EMPIRE LIFE EMBLEM CONSERVATIVE PORTFOLIO GIF

EMPIRE LIFE EMBLEM CONSERVATIVE PORTFOLIO GIF