PORTFOLIO MANAGERJennifer Law, CFA

Ian Fung, CFA

Empire Life Investment Team |

WHY INVEST IN THIS FUNDYou are seeking growth and income by investing primarily in Canadian equity and fixed income securities |

FUND FACTS| Asset Class | Canadian Balanced |

|---|

| Size (Mill) | $54.2 |

|---|

| MER (2019) | 2.09 % |

|---|

| Inception | January 9, 2012 |

|---|

| Total Holdings | 254 |

|---|

|

RISK TOLERANCE | | | | | | | | | |

|---|

| low | low to medium | medium | medium to high | high |

|

ASSET MIX| Canadian Equities | 49.5 % |

|---|

| Canadian Bonds | 36.9 % |

|---|

| U.S. Equities | 6.1 % |

|---|

| Cash and Cash Equivalents | 2.8 % |

|---|

| International Equities | 2.5 % |

|---|

| U.S. Bonds | 2.2 % |

|---|

SECTOR MIX| Financials | 29.2 % |

|---|

| Energy | 14.3 % |

|---|

| Industrials | 13.3 % |

|---|

| Materials | 9.3 % |

|---|

| Information technology | 8.4 % |

|---|

| Utilities | 7.5 % |

|---|

| Consumer staples | 7.3 % |

|---|

| Real Estate | 5.0 % |

|---|

| Communication services | 4.1 % |

|---|

| Consumer discretionary | 1.6 % |

|---|

|

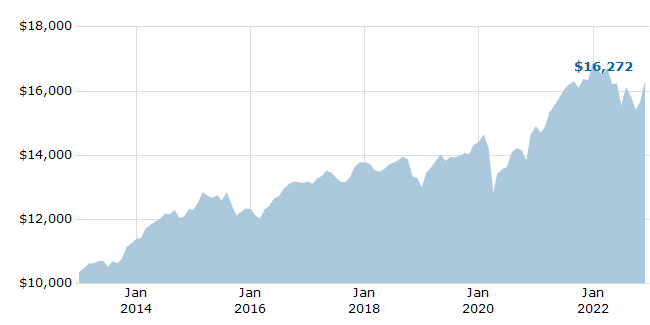

GROWTH OF $10,000 - SINCE INCEPTION

For Illustration Purposes Only

|

TOP 10 HOLDINGS| Royal Bank of Canada | 3.3 % |

|---|

| ROYAL BK OF CAD 2.65% 01MAY25 TD | 2.6 % |

|---|

| Enbridge Inc. | 2.2 % |

|---|

| Toronto-Dominion Bank | 2.0 % |

|---|

| Canadian Pacific Railway Limited | 1.7 % |

|---|

| WSP Global Inc. Com | 1.5 % |

|---|

| Brookfield Asset Management Inc. 'A' | 1.4 % |

|---|

| Microsoft Corp. Com | 1.4 % |

|---|

| Canadian Imperial Bank of Commerce | 1.3 % |

|---|

| Bank of Montreal | 1.3 % |

|---|

| Total of Top 10 | 18.8 % |

|---|

|

COMPOUND ANNUAL RETURNS| 1 mo | 3 mo | YTD | 1 yr | 3 yr | 5 yr | 10 yr | Inception |

|---|

| 3.86 | 2.97 | -3.45 | -0.31 | 4.36 | 3.39 | | 4.57 |

CALENDAR YEAR RETURNS| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|

| 7.88 | 0.19 | 6.91 | 4.63 | -5.93 | 11.10 | 3.33 | 13.25 |

RECENT DISTRIBUTIONS| Dec-2021 | Jan-2022 | Feb-2022 | Mar-2022 | Apr-2022 | May-2022 |

|---|

| 0.1023 | 0.0418 | 0.0418 | 0.0418 | 0.0418 | 0.0418 |

| Jun-2022 | Jul-2022 | Aug-2022 | Sep-2022 | Oct-2022 | Nov-2022 |

|---|

| 0.0418 | 0.0418 | 0.0418 | 0.0418 | 0.2293 | |

|

EMPIRE LIFE

EMPIRE LIFE  EMPIRE LIFE

EMPIRE LIFE