PORTFOLIO MANAGEREmpire Life Investment Team |

WHY INVEST IN THIS FUNDYou are seeking growth and income by investing primarily in equity and fixed income securities, with a target equity allocation of 80% |

FUND FACTS| Asset Class | Portfolio Funds |

|---|

| Size (Mill) | $279.8 |

|---|

| MER (2019) | 2.41 % |

|---|

| Inception | January 9, 2012 |

|---|

| Total Holdings | 435 |

|---|

|

RISK TOLERANCE | | | | | | | | | |

|---|

| low | low to medium | medium | medium to high | high |

|

ASSET MIX| Canadian Equities | 54.1 % |

|---|

| Canadian Bonds | 15.3 % |

|---|

| International Equities | 14.2 % |

|---|

| U.S. Equities | 12.9 % |

|---|

| Cash and Cash Equivalents | 3.2 % |

|---|

| U.S. Bonds | 0.3 % |

|---|

SECTOR MIX| Financials | 26.3 % |

|---|

| Industrials | 14.1 % |

|---|

| Energy | 11.6 % |

|---|

| Information technology | 10.3 % |

|---|

| Materials | 8.9 % |

|---|

| Consumer discretionary | 6.7 % |

|---|

| Consumer staples | 6.7 % |

|---|

| Communication services | 6.2 % |

|---|

| Utilities | 4.2 % |

|---|

| Health care | 3.4 % |

|---|

| Real Estate | 1.6 % |

|---|

|

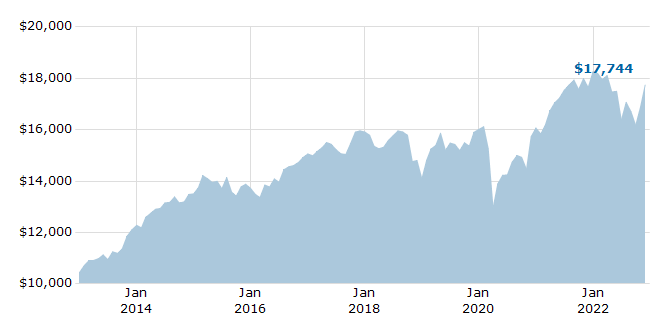

GROWTH OF $10,000 - SINCE INCEPTION

For Illustration Purposes Only

|

TOP 10 HOLDINGS| Royal Bank of Canada | 3.6 % |

|---|

| Toronto-Dominion Bank | 2.7 % |

|---|

| Agnico-Eagle Mines Ltd. Com | 1.9 % |

|---|

| Canadian Natural Resources Ltd. Com | 1.7 % |

|---|

| Sun Life Financial Inc. Com | 1.6 % |

|---|

| Canadian Pacific Railway Limited | 1.6 % |

|---|

| Bank of Montreal | 1.6 % |

|---|

| Enbridge Inc. | 1.6 % |

|---|

| Alimentation Couche-Tard Inc. Com | 1.5 % |

|---|

| Brookfield Asset Management Inc. 'A' | 1.5 % |

|---|

| Total of Top 10 | 19.1 % |

|---|

|

COMPOUND ANNUAL RETURNS| 1 mo | 3 mo | YTD | 1 yr | 3 yr | 5 yr | 10 yr | Inception |

|---|

| 5.02 | 6.19 | -2.84 | 0.53 | 3.71 | 2.14 | | 5.40 |

CALENDAR YEAR RETURNS| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|

| 9.94 | 1.64 | 9.72 | 5.70 | -11.46 | 13.66 | 0.33 | 13.63 |

RECENT DISTRIBUTIONS| Dec-2021 | Jan-2022 | Feb-2022 | Mar-2022 | Apr-2022 | May-2022 |

|---|

| 0.5668 | | | | | |

| Jun-2022 | Jul-2022 | Aug-2022 | Sep-2022 | Oct-2022 | Nov-2022 |

|---|

| | | | | 0.4191 | |

|

EMPIRE LIFE

EMPIRE LIFE  EMPIRE LIFE

EMPIRE LIFE